Every few months, Dr. Richard Bohannon watches in frustration as a 73-year-old woman he treats for chronic leukemia goes through a painful ritual. She arises early, drives 40 miles to San Francisco from her home across the bay, then spends the next nine hours in the hospital linked to an intravenous tube replenishing her worn-out blood with a fresh supply. When the tube is removed, she drives home.

At one time, Bohannon hospitalized the woman the night before her transfusion. “She’s weak and frail. She tires easily. It’s hard for patients to go through that,” explains Bohannon, a specialist in blood disease and cancer and an associate professor of medicine at the University of California, San Francisco.

Dr. Richard Bohannon

But for almost two years now, Medicare has refused to pay for the hospitalization. Reviewers hired by the federal government say that the transfusion can be done just as safely, and much less expensively, on an outpatient basis.

“It upsets me that my judgment isn’t more important than…some general rule,” Bohannon says. Still, his appeal of the decision was denied.

These days, it’s not just the government that’s interested in the details of Bohannon’s medical practice, either. A health maintenance organization (HMO) whose members are seen by Bohannon and his two partners sends him a quarterly computer print-out showing how much he is spending for each HMO patient on examinations, laboratory tests, hospitalization and other care. The printout also tells Bohannon how he compares to other doctors affiliated with the HMO.

To make the point of more than academic interest, Bohannon is reminded that 15 percent of his and other physicians’ fees is being withheld until the HMO sees whether it meets yearly financial goals. The quarterly print-out shows the plan’s progress.

Meanwhile, Bohannon has reluctantly joined a new HMO that caters to the elderly. This HMO’s management intends to withhold 20 percent of each doctor’s fee until as long as six months after the year ends to make sure that expenses stay under control.

Though he thinks the arrangement is unfair, the 53-year-old internist feels he has no choice. “(They) own the building I’m in. I can’t really afford to refuse,” he says.

Besides, Bohannon notes, he has to be competitive to survive. If some independence must be sacrificed to keep the waiting room full, so be it.

“I want to see patients. I don’t want to sit around and see empty spaces in my appointment calendar,” he says.

The trade-offs between autonomy and economics confronting Bohannon are not unique. Physicians from Boise, Idaho, to Birmingham, Ala., are increasingly facing the same dilemma. Like airline pilots or bankers, physicians are finding that their life has radically changed.

Trained to think in clinical terms, doctors are discovering that their fee schedule could determine their patient schedule. Accustomed to near-total freedom in deciding how to treat a patient, doctors now find that a patient’s age or type of health insurance will determine decisions as basic as whether he can be hospitalized or which hospital can be used.

That increased second-guessing before, during and after treatment comes from other physicians designated as “reviewers” does not always make the pill easier to swallow. Behind the Medicare “peer review organization” stands the federal government. Behind private reviewers there is often a corporate voice calling the tune.

“What we’re seeing is a whole change in the focus of control away from the physician,” asserts Victor Fuchs, a Stanford University economist and author. “The biggest problem is physicians understanding they’ll have to share power.”

“It’s like death and dying,” adds Karen Zupko, a. consultant to doctors on how to manage their practices. After years of denial, physicians are learning that “the days of ‘don’t worry about it, the money will come in, you’ll have the patients,’ that’s over. They know that.”

It is not an easy lesson to learn, especially for doctors with more than two decades of practice shaping their views. In a working class suburb of Milwaukee, Dr. Anthony Ziebert, 50, sees that his HMO has allotted $25 per patient per month but that costs have risen to $29. His “withhold,” meanwhile, has risen to 20 percent of his fee from 15 percent as the HMO falls further behind in its financial projections.

Ziebert says he’ll absorb a loss on his HMO patients rather than change the way he gives care. “It’s too wrenching,” he explains. Leaving the HMO, he adds, is not an option.

In Louisville, Dr. Gary Fox is also learning to understand power. Humana Hospital-Audubon is building a “center of excellence” around the neurology skills of he and his partners, skills publicized by Fox’s treatment of artificial heart recipients who suffered strokes. The center will likely mean extra income, but Fox shows little joy.

“I used to love to come to work everyday. I’m probably halfway up the ladder now between love and hate,” says the 50-year old Louisville native. “The thing I do best is see patients. And now half the things I do have nothing to do with patients. Everybody has his hands in my pockets. The (plan) here wants a discount. This group is making a deal with that hospital.

“(And) if we don’t keep ahead of it, and market the practice in a low-key way, we’ll be nailed.”

Dr. William Weil, meanwhile, cheerily admits that it was his shrinking patient load that led him to discover that even in an affluent Los Angeles suburb times had changed. “I thought they loved me. It was a rude awakening to find patients were influenced by the price,” says the 54-year-old family practitioner.

Weil recently gave up his long-time solo practice for a department chairmanship of a local, staff-model HMO.

Behind the anecdotes lies a fundamental change.

“Health care has started the process of reinvesting itself,” says John Elkins, executive vice president of the Naisbitt Group, a consulting firm formed by the author of the best-seller, “Megatrends.” “The industry is going through a permanent restructuring.”

The roots of the change go deep, involving factors such as the emergence of “scientific” high-technology medicine in place of the “art” practiced by doctors in the past and the replacement of the post-war physician shortage with a growing physician surplus.

But the symbol of change is easy to pinpoint. On Oct. 1, 1983, the federal government did to health care what it had done to the airline and banking businesses, among others, and began removing a protective umbrella of price regulation. Hospitals, which get about 40 percent of their revenues from Medicare, would no longer be reimbursed based on their individual costs, however inflated. Instead, Medicare started phasing in a system that paid a fee set in advance based on 468 different procedures, or diagnosis-related groups (DRGs).

Under “prospective” payment, hospitals whose costs were higher than the DRG fee would simply lose money. But those whose costs were lower could keep part of the difference.

Commented Peter Grua, an analyst with the Chicago investment banking firm of Wm. Blair & Co., “All these years (doctors) have been concerned with fighting socialized medicine, and now they’ve been blindsided by capitalism.”

On one level, marketplace medicine was an almost instant success. For a decade, national health-care expenditures had soared upward far faster than general inflation as doctors and hospitals stymied federal rate-setting efforts and ignored the “voluntary effort” ballyhooed by their trade groups.

In 1984, medical expenditures broke the $1 billion-a-day barrier, reaching $387.4 billion, according to the Health Care Financing Administration. That made medicine the nation’s second-largest industry, after agriculture. Perhaps just as importantly, about $66 billion of those dollars went to Medicare from an increasingly budget-conscious federal government while another $19 billion represented the federal share of Medicaid.

Prospective payment did not apply directly to doctor’s bills, only to the total cost of care in a hospital. However, an estimated 60-80 percent of a hospital’s costs are physician-related.

Doctors got the message.

In the 15 months from the time the first hospitals began phasing in prospective payment to the end of 1985, the average length of stay for patients over age 65 dropped nine percent, according to the American Hospital Association. The average hospital occupancy rate plummeted 10 percentage points, to 63.6 percent, a record low.

Bettering the “average” length of stay assumed for each illness by the DRG system is, of course, the key to a hospital making, rather than losing, money. During the first year of prospective payment, according to figures from the Inspector-General of the Department of Health and Human Services, hospital profit margins surged to a record high. (The AHA disputes the government numbers.)

“Revolution is a better word than change,” is how Dr. Harrison L. Rogers Jr., president of the American Medical Association, described the new atmosphere to a meeting of the AMA’s chapter leadership. “The purchasers of care, both large and small, now insist on quality of care at the most economic price you can deliver.”

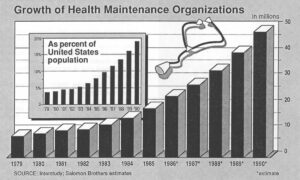

Encouraged by Medicare’s results, private employers stepped up their demands for health-care cost containment. In response, “preferred provider organizations” (PPOs) sprang up offering companies a network of doctors and hospitals that agreed to discount fees and, often, submit to some review of patient care, in return for an increased volume of patients. Different forms of HMOs have also blossomed.

In California, a leader in competitive medicine, a state medical association attorney said she has received contracts offered doctors by a mind-boggling 352 HMOs, PPOs and various hybrids. Three years ago, there were fewer than a dozen.

Though individual physician totals are hard to establish, one San Diego physician who currently claims affiliation with 12 groups is also planning to add the 15 Medicaid plans the state will soon open in his area.

“Just as restaurants have many credit cards in their window, expect physicians to have many (HMO and PPO) credit cards in their windows,” predicts William Gold, president of Chicago’s Anchor HMO.

Though it may be extreme, a widely-quoted report by Sanford C. Bernstein & Co. predicts that 65 percent of all patients will belong to an HMO or PPO within five years. “The vast majority of the population will be in some such sort of health-care delivery system, and fee-for-service medicine as we know it now will be dead,” concludes Bernstein analyst Kenneth Abramowitz.

In Minneapolis-St. Paul, where the penetration of HMOs and PPOs is reaching 50 percent of the under 65 population, even the mighty Mayo Clinic isn’t immune. According to Dr. W. Eugene Mayberry, chairman of the Mayo Clinic’s board of governors, the clinic sees 5.1 patients for every 1,000 persons in the area whose insurance allows the standard fee-for-service medicine. By contrast, HMOs refer only 0.4 patients per 1,000 enrollees to the clinic for care.

The clinic responded with a strategy change ranging from diversifying with planned Sunbelt branches in Jacksonville, Fla. and Scottsdale, Ariz. to boosting its clout in the Minneapolis area by merging with two affiliated hospitals to form a corporation with more than $750 million in revenues and 14,000 employees.

If the Mayo example shows that quality medicine is no protection from the new economics, the question remains whether the new economics will itself protect quality medicine.

There are doubters. Surveys by the American Medical Association and American Society of Internal Medicine and hearings by the Senate Special Committee on Aging turned up repeated evidence of seriously-ill Medicare patients discharged from hospitals too early and too ill to cope. Critics say the evidence is early and anecdotal and note that the federal government has responded with beefed-up monitoring by its reviewers.

They also point to abuses of the fee-for-service system that endangered patients with unnecessary tests and surgery.

But others wonder whether the new economic pressures might not split doctors’ loyalties between economics and medicine, costing doctors their most precious possession, the trust of patients. One of those bothered is Dr. Arnold Relman, editor of the New England Journal of Medicine.

“We are the trusted agent of our patients. We are not vendors, we are not businessmen in the sense that business markets its services to customers,” Relman says.

“We must be the patient’s advocate–that is the heart of medicine. The patient cannot operate on the assumption of caveat emptor.”

©1986 Michael Millenson

Michael Millenson, a reporter on leave from the Chicago Tribune, is chronicling the deregulation of the American health-care system.