David Burnham

- 1987

Fellowship Title:

- The Internal Revenue Service

Fellowship Year:

- 1987

Equal Treatment Under The Law?

Production statistics collected by the Internal Revenue Service suggest that taxpayers in different parts of the United States do not receive equal treatment from the giant agency. Some of the apparent disparities are astonishing. While 21 out of every 1,000 taxpayers were audited last year in the IRS’s San Francisco district, only 6 out of 1,000 taxpayers faced the same process in Massachusetts. Data published in the IRS’s most recent annual report and information provided by the agency appears to indicate many other similar aberrations. Why did the IRS audit only 9 out of 1,000 taxpayers in Chicago, when 15 out of 1,000 were audited in Manhattan? Why were the returns of 7 out of every 1,000 Iowans examined, when 15 out of every 1,000 North Dakota taxpayers were asked to defend their financial claims to the government? Does it make sense that Utah taxpayers are almost twice as likely to face audits as those living in Colorado? The district to district auditing variations appear even more astonishing when economic factors such as the average

Quotas

About a year ago, a middle level official in the Internal Revenue Service named Wilbur E. McKean sent a pointed one page memorandum to the six group managers under his immediate command. McKean, the man in charge of the Baltimore District’s Field Branch II, was not happy with his managers. “I am sure each of You has analyzed and evaluated the January report for your group,” he wrote. “Personally, for a five week period, it is a sorry report. Not one manager has come forward to explain the poor performance statistical indicators.” McKean was talking numbers, numbers of seizures that had been performed, numbers of investigations closed, numbers of criminal tax matters that had been uncovered. And he wanted production. During the January reporting period, he said, the 91 revenue officers and staff assigned to Field Branch II had made only seven seizures and referred only one case to Criminal Investigating Division. “It appears the fewer cases that the revenue officers have assigned to them, the less work they do,” McKean told the six supervisors.

The Numbers Game

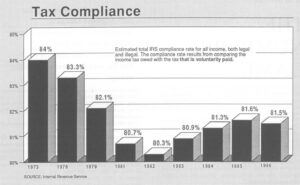

At a national conference last year on the genuinely worrisome problem of the federal deficit, Michael Dukakis, the Democratic presidential candidate and governor of Massachusetts, denounced the “scandalous gap between our tax laws and compliance with those laws.” “The problem,” he said, “is that tax compliance is declining at an alarming rate. Twenty years ago, according to the Internal Revenue Service, the tax compliance rate in the United States was approximately 94 percent. Last year, our tax compliance rate in the United States had dropped to approximately 81 percent, which means that as of this moment one out of every five Americans isn’t paying the taxes he owes.” Dukakis added that “the difference between a 94 percent compliance rate and an 81 percent compliance rate is $65 billion a year in revenue.” It was a dramatic, eye catching statement, especially useful for a liberal politician who wants to establish himself as a frugal tough-minded manager, one who also has sought to make stronger tax enforcement an important part of his bid for the White House.

Automated Assessments

A few months ago, the Internal Revenue Service handed out a two page press release describing a new computer tracking system it has recently cranked up. The IRS said the system had two distinct goals; improve the detection of those individuals who don’t file any income tax returns at all and automatically calculate what they owe the government. Perhaps because the announced target of the new system has always been considered a loathsome class, genus tax cheat, the IRS plan received little notice. But the January startup of this complex automated detection system by the nation’s largest and most powerful civilian agency represents the culmination of a major series of technological advances in the administration of the 74 year old federal income tax. At the same time, the new system may provide the clearest warning yet of an impending shift in the basic relationship between the American people and their government, an increasing pacification of the citizen taxpayer. The initial goals of the new Internal Revenue Service system seem relatively modest. At very little cost