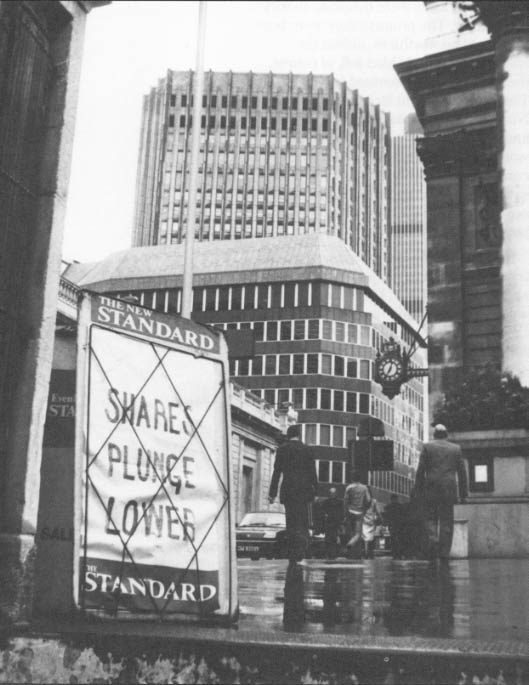

In September 1992, the vision of united European nations sharing something like a common currency was swept away like a mirage by international currency traders who forced Britain’s withdrawal from the European exchange rate mechanism (ERM). With the economy of Britain already in recession, Prime Minister Major’s often-repeated commitment to British membership in the ERM meant sacrificing more jobs, more homes, more people on the altar of monetary stability. Currency speculators bet that the sacrifice would be too great to sustain. They won and won big. Britain withdrew from the ERM, even as speculators at-rayed their forces against the other currencies in ERM. The currency speculators moved like a tide, and government authorities who stood against them had only the reed of rhetoric, which could not stop the tide. The recent crisis in Europe was a clear case of vigilante justice in the economic sphere. But it is only the clearest, most recent and most visible case of vigilante economics at work.

When Major vowed to protect Britain’s currency against devaluation and inflation, he offered a sure bet to the speculators. Every day, according to a 1990 report of the Bank for International Settlements, the currency traders move $650 billion at the speed of light, placing bets that determine the direction of economics like Britain’s. Add up all of the Saudi oil, Japanese cars, American wheat, European aircraft, and throw in the rest of things that countries buy and sell from each other and you will get only a fraction of the $650 billion. The rest is traded for profit in a fast moving market where “the long run” means ten minutes, and that’s plenty of time to win or lose millions.

The currency market, which consists mostly of speculators, is much more powerful than governments like Britain’s. Ultimately, speculators decide what interest rates homeowners will pay, what a country’s exports or imports will be worth, what governments can or cannot do with their country’s economic policies. Although the creation of money is a sovereign right of nations, speculators decide what the money will be worth. Although international economic cooperation is an ideal of statesmen, speculators decide whether it will be allowed to proceed. In the early 1970’s their predecessors had brought down the Bretton Woods system, a worldwide agreement among governments to ensure global financial stability. In September, they demolished Europe’s smaller-scale currency agreement, the exchange rate mechanism (ERM).

Major was committed to ERM. But demand and supply are the law of the markets. Because German interest rates were high, international investors bought up German bonds. They had to sell something in order to buy marks, and they sold pounds. This drove the price of the pound down. There were only two ways that Prime Minister Major’s government could keep the pound in line. The first was to buy up the pounds coming on to the market. But although the British crown created the pound, the British government cannot afford to buy many of them. At the end of 1991, the total foreign exchange reserves of the Bank of England amounted to only $42 billion, a laughable sum compared to the $650 billion that moves through the foreign exchange markets every day. The second way was to raise interest rates so that investors could earn as much from British bonds as they could from German bonds. Raising interest rates means that British borrowers, including home buyers and small businesses, would have to pay more, for their money. When interest rates go up, people put off buying houses and businesses put off borrowing to expand. The economy slows down.

Vigilante economics forces governments to face the consequences of their failed promises and contradictory policies. It is a fundamental law of economics that every good has a cost. Vigilante economics makes sure that governments pay, one way or another, when deeds and words do not match. Until relatively recently governments could cooperate enough to make a stand against the vigilantes. But the past decade shows that such cooperation is impossible to sustain. Its consequence has been a breakdown of old economic order, and a shift to the rough and ready discipline of the market.

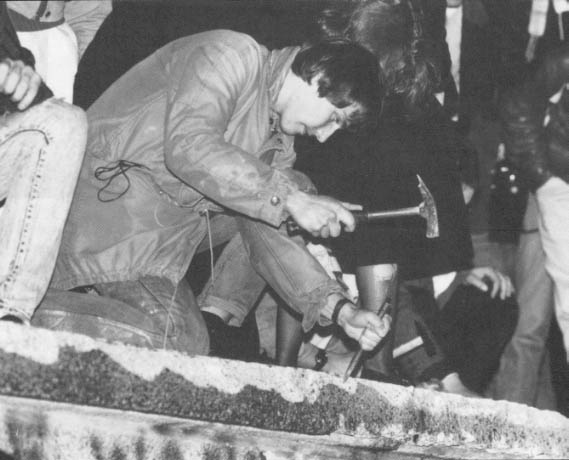

During the 1980’s, there was a revolution in finance. Because governments failed to provide the financial equivalent of law-and-order, markets took the law into their own hands. Vigilante economics acknowledges no national borders, bows to no regulatory authority, and accepts no rule but the rule of financial power. Vigilante economics enforces rough justice against all those, who violate fundamental economic laws. The vigilantes broke down walls that once protected privilege, and emasculated traditional institutions, no matter how ancient or revered. The New York Stock Exchange, founded under a buttonwood tree in Lower Manhattan 200 years ago, had hardly changed since the days when traders in powdered periwigs toasted the health of Treasury Secretary Hamilton. A comfortable monopoly on stock trading virtually guaranteed prosperity to members of this elite Club. But stock index futures changed all that. Introduced on the Chicago commodity exchanges in 1982, index futures allowed investors to play the New York stock market without paying commissions to New York Stock Exchange members. A stock index is Merely a list of stocks: a stock index future is a bet on the future value of the stocks on the list. A buyer of S&P index futures can benefit from a rise in the stock market just as if he had bought every stock on the index. But actually buying every stock oil tile index would funnel commission dollars into the pockets of New York stock exchange members. Buying a futures, contract does not. As more investors recognized the benefits of investing in futures rather than stocks, the New York Stock Exchange member firms came tinder pressure. “Futures changed the centers of power as far as the market was concerned, and disenfranchised money managers who had built their business on the old ways the market worked,” says Ivers W. Riley, senior, executive vice-president at the American Stock Exchange.

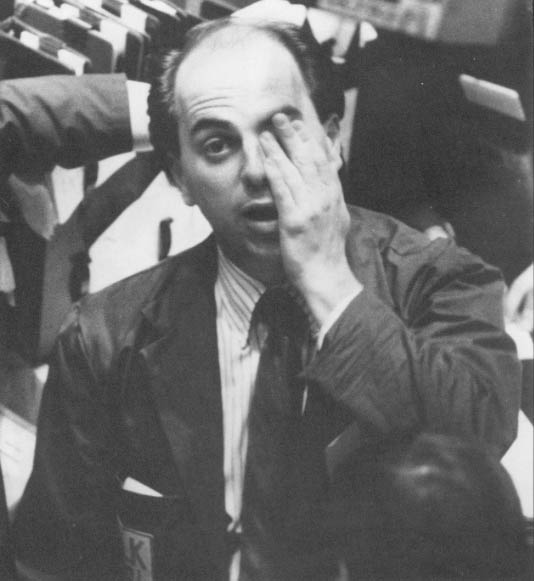

The crash of 1987 brought the conflict to a head. Desperate investors rushing to get out of stocks sold futures. Stock prices followed futures prices down. Their monopoly clearly broken, the old men of Wall Street cried out for government regulation. Neuberger & Berman, a traditional New York Stock Exchange member firm, paid for full page advertisements in the New York Times urging people to write their Congressman and support legislation to give the Securities Exchange Commission authority over futures. Meanwhile, business publications decried “program trading,” a technique used by sophisticated investors to profit when stock prices and futures prices are out of line. Congressman, John Dingell, chairman of the powerful Energy & Commerce committee that oversees the SEC, publicly compared futures to “cockroaches”. But beyond the Beltway, beyond the Rockies, and beyond the Pacific, the lines for a greater conflict formed quietly. The skirmish between Chicago and New York foreshadowed the battle for control of Japan’s capital markets.

In March of this year, in a letter to the Japanese Ministry of Finance, Congressman Dingell emerged as a defender of futures trading techniques that have made US investment banks the most profitable financial institutions in Japan – at the expense of Japanese institutions.

Congressman Dingell’s staff sees no inconsistency in his positions. Futures might be cockroaches, but in this case, they’re our cockroaches. And they’re Winning.

GORDON GEKKO MEETS GODZILLA

The decade of the nineties dawned under a Japanese sun. Tokyo was invincible. Doubters needed only look to the Nikkei to be convinced. The broad index of Japanese stocks had risen far beyond any level Western analytical techniques could comprehend. “There was a feeling in Japan that the Japanese market could not go down. You ran into this in 87, 88, even 89. They felt there was something very special about their market, about Japan, that it was defying, any law of gravity that might exist elsewhere in the world,” recalls Gary Gastineau, a vice president responsible for derivatives at Swiss Bank Corporation. Japanese insurance companies were the biggest investors in Tokyo. They had several reasons for accepting the curious offer made to them by a number of American investment bankers, but surely the most persuasive was the notion that the Americans would pay cash in return for a worthless promise. What the Americans wanted was the right to sell Japanese stocks to the Japanese insurance companies at a price far below the market price, The Americans offered to pay if the Japanese would commit to buy stocks for less money than the stocks were selling for on the Tokyo Stock Exchange.

The Americans were throwing money at a fantasy. The promise they were buying would be worthless, unless the Nikkei fell. If the Nikkei fell, of course, then the price that seemed low in 1987, or 1988, or 1989 might look high. But the Nikkei was the Japanese stock market, and Japan was invincible. The Nikkei would never fall. Japanese insurance companies knew a good deal when they saw it. They sold their promises, which are called index put options in Financial jargon.

No one outside of the Japanese Ministry of Finance knows exactly how many such promises those Japanese companies, sold in the secretive, unregulated, over-the-counter derivative market, where financial institutions trade among themselves. In a 1991 speech, however, Securities Exchange Commissioner Mary Schapiro estimated that the total volume of over-the-counter options on all the worlds indexes ranged from $10 billion to $75 billion, and most were, on the Nikkei. At the American Stock Exchange, Ivers Riley was watching the growth of this over-the-counter market with considerable interest. A former Navy pilot who patrolled the South China Sea, Riley didn’t swallow the notion that the Nikkei had nowhere to go but up. “It was a big bubble and should have burst long ago,” he says. Riley figured that if the big investment banks thought that Nikkei put options were a good bet, there ought to be an opportunity to sell them to the public. It took a year and a half just to get the necessary regulatory approvals from the SEC, and to negotiate an information sharing agreement with the Tokyo Stock Exchange. The Nikkei continued to rise.

But on January 12, 1990, the American Stock Exchange listed a unique, new security: put warrants on the Nikkei. On the strength of promises they had bought from the Japanese insurers, investment bankers at Goldman Sachs in turn sold promises to the Kingdom of Denmark. On the strength of those promises, the Kingdom of Denmark in turn sold a promise to buyers of the put warrants. The Kingdom promised to pay warrant holders if the Nikkei tell. In effect, the Kingdom was “renting” its name to Goldman to give the warrants a touch of class. They sold so well that Solomon, Paine Webber and Bankers Trust raced to market with similar securities.

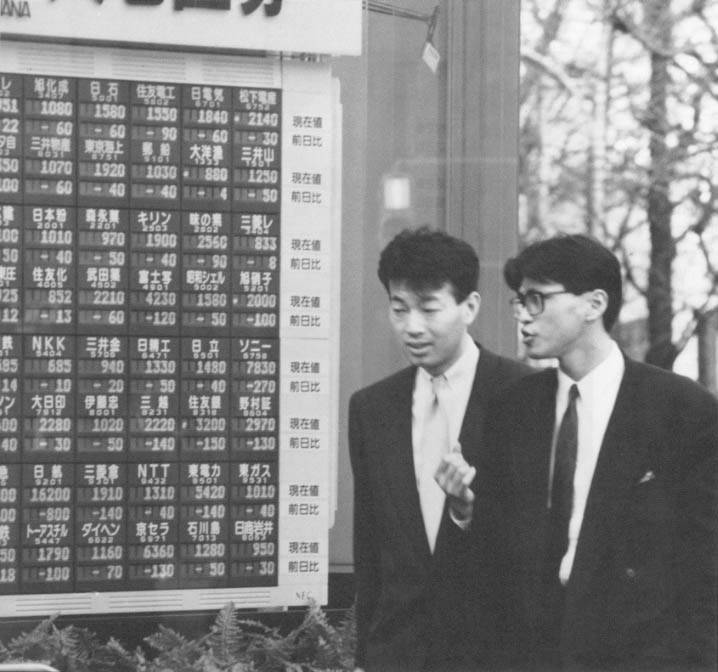

The promises that they had made came back to haunt the Japanese insurers. The very month that the put warrants had been issued, the Nikkei’s wings failed. For two years, the red sun sank, like a meteor, down. By 1992, Japan’s market had lost 60% of its value. As this article goes to press, no one is sure if it has fallen as far as it can fall.

No one is sure how great will be the damage to Japan’s insurers, or to other Japanese companies that signed on to derivative deals during the heady days when everyone thought the Nikkei could only go tip. The farther it falls, the greater their liability will be.

The effects of the crash have been felt far beyond the trading floor of the Tokyo Stock Exchange. As the value of their investments dwindled, for example, once-mighty Japanese banks lost their coveted triple-A credit ratings, and fell out of compliance with capital standards set by the Bank for International Settlements. These capital standards define the world’s elite financial institutions. The Japanese competitive threat waned in banking. By August 1992, Japan faced the prospect of widespread bank failures, and plans for an unprecedented bank bailout dominated the country’s economic policy debate.

The market crash also threatened Japan’s long-run dominance of manufacturing industries. Before the Nikkei fell, Japanese companies had been able to raise money at less than half the cost of capital for US firms. “To put the consequences of Japan’s cost of capital advantage in numerical terms, in the past five years, Japanese semiconductor companies have invested $10 billion more in R&D, plant, and equipment than US suppliers were able to invest. And they gained more than 10 points of market share – most of it at the expense of US companies,” Texas Instruments CEO Jerry Junkins had told an audience at the Japan Society in 1989. Thanks to the crash in Tokyo, American manufacturers have one less headache when it comes to competing with Japan. “The ability to raise money cheaply on the stock market was a competitive advantage for Japanese companies. The fall and the continued weakness of the Nikkei has substantially eliminated that advantage,” says Douglas Ostrom, senior economist at the Japan Economic Institute, a research organization funded by the Japanese Foreign Ministry.

DID THE NIKKEI FALL OR WAS IT PUSHED?

Corruption scandals had plagued the Tokyo market, corporate earnings were down, and Japanese stocks long sold for higher prices than many analysts thought they were worth. There was speculation that uncertainty over the Soviet political climate contributed to the initial fall. But Tokyo Stock Exchange officials blame the foreigners and their derivatives for Japan’s market collapse. “They’re almost seen as black ships invading Japan,” says Ostrom, in a reference to the black fleet of Commodore Perry, who forcibly opened Japan to the world in 1853.

The spectacle of foreigners profiting from Japan’s distress inflamed the Japanese Ministry of Finance. It is a fact that derivative traders only make money when markets are volatile and unstable. “If the world got more stable tomorrow, they’d disappear,” says Charles Smithson, a managing director at Chase and a prolific author on the subject of derivatives. Smithson doesn’t believe that derivatives cause volatility, and most academic studies bear him out.

But derivatives do allow dealers to profit from market turbulence. After the 1987 market crash in the US, a presidential commission headed by Treasury Secretary Nicholas Brady had recommended a number of regulatory measures to control derivative trading, which the commission blamed for making the crisis worse. Japanese authorities reached similar conclusions about their own market. According to Mitsu Sato, Deputy President of the Tokyo Stock Exchange, the Nikkei futures market has grown to be five times as large as the Japanese stock market. This indicates that investors have shifted from the cash market, where they bought shares of stock, to the futures market, where they play the stock indices. But companies issue stock to raise capital, and corporate managers look to their company’s stock price as the scoreboard of their own performance. Sato says that the shift of investors from the Japanese stock markets to the futures markets threatens this valuable economic function. “For one thing, it implies a weaker stock market as compared to the derivatives markets,” he said. “Derivatives are beneficial to the economy only insofar as they contribute to a stronger cash market by providing hedging opportunities that would not otherwise exist. No one, of course, can raise funds in the derivative markets as such, however large such markets have become. In this sense, we should avoid having the tail wag the dog.” Japanese regulators in their turn tried everything to rein in derivatives trading. But they learned the hard way that their market isn’t theirs anymore.

The Tokyo Stock Exchange invoked a clause in its information sharing agreement with the Amex to stall any further issues of Nikkei put warrants. But the Amex developed a Nikkei clone called the Japan Index. Despite top-level negotiations between the Japanese Ministry of Finance and the US Securities Exchange Commission, Japanese authorities failed to block trading of options on the Nikkei clone.

In order to stymie program trading, Japanese regulators imposed restraints on index futures trading in the Osaka Futures Exchange. The restraints had real teeth – The Japanese regulations raised the cost of trading in Osaka, and imposed limits so strict that on some days the Osaka exchange has only been able to trade -Nikkei futures for five minutes.

Although they have succeeded in strangling the trading of derivatives in Osaka, the Japanese watched helplessly as program traders took their futures business to Singapore, where Nikkei futures have long traded on the Singapore International Mercantile Exchange (SIMEX). It doesn’t matter where in the world a program trader buys or sells futures. The economic effect is the same. SIMEX trading volume has leapt ten-fold since the Nikkei began to slide. Says Ang Swee Tian, president of SIMEX, “Market participants, be they portfolio hedgers or program traders, can have their trades executed at SIMEX. Our rules do not restrict their participation.”

Aug says that senior officials of the Tokyo Stock Exchange have “initiated discussions” in an attempt to make Singapore impose restrictions on program trading. But SIMEX has no interest in the Japanese effort to freeze out derivatives.

“We have conveyed to the Tokyo Stock Exchange that SIMEX, being an independent exchange incorporated in the Republic Of Singapore, it can never subject itself to the jurisdiction of a foreign exchange,” he declares.

Japanese efforts to stop the foreign Financial juggernaut have not only been impotent – they have drawn fire from the U. S. Congress. In March, Congressmen Schumer, Gonzalez and Dingell wrote a bluntly worded letter to Japan’s Minister of Finance, Honorable Tautomo Hata, that put the issue squarely in the context of free trade. Citing program trading restrictions, the, Congressmen wrote, “Unfortunately, this is yet another example of a troubling pattern which Japanese officials have repeated time and time again with regard to U. S. competition in the Japanese market. It is time that this trend is stopped.” These august legislators did not see fit to mention their own criticisms of derivative trading during the 1987 New York Stock Exchange crash, incidentally.

GUNBOATS ON THE THAMES

Japanese regulators stood in the path of the economic vigilantes, and the vigilantes mowed them down. The same thing happened to the Germans.

Today, the price at which German government bonds will sell is decided on a futures exchange in London. Futures exchanges had been illegal in Germany since the Great Depression, but during the 1980’s, international investors decided that there was money to be made trading futures on Germany’s national debt. So the London International Financial Futures Exchange (LIFFE) listed a German Bund contract.

The contract soon became one of the most popular products traded at the LIFFE. The German mark is an international currency, German bonds and stocks attract investors from all over the world, and international investors do not necessarily share the interests of the German government where interest rates are concerned. As a result, German financial authorities feel that they have lost a large measure of control over their nation’s Financial system.

A source at the Bundesbank, Germany’s central bank, says, “As a national bank, we are not happy about Such contracts in our own currency which are traded outside of Germany. Our partners in policy are the German banks and not the market participants abroad. If we try to exercise our influence on the market, we cannot reach the market participants abroad. “ Traditionally, a small number of German bankers worked hand-in-glove with the government to maintain stability in Germany’s Financial system. London shattered their tight little, club, just as decisively as Chicago shattered the New York Stock Exchange and American investment bankers shattered the Tokyo Stock Exchange.

But in London, Michael Jenkins, chief executive of LIFFE, politely dismisses Germany’s discomfort with the exchange’s unwelcome role in German finance: “I think it’s essentially pure nationalism. If the Bundesbank had good grounds, had said, ‘we would rather you didn’t for these reasons,’ then I think in the interest of national harmony we would probably have paid attention. But they didn’t, so we went ahead.”

Jenkins may be right, but it’s also fair to say that monetary stability in Germany is not the topmost concern of the vigilantes in London. They use futures to immunize their German investments against changes in interest rates. Futures bring a measure of stability in an unstable world, where governments sometimes make surprising shifts in financial policy, and where the financial effects of events like Germany’s unification are unpredictable. Futures speculators, like insurance companies, make money by taking these risks. Because insurance is available, more people are willing to invest in German securities, and Germany is able to borrow more money, ore cheaply than it could if there were no futures exchange.

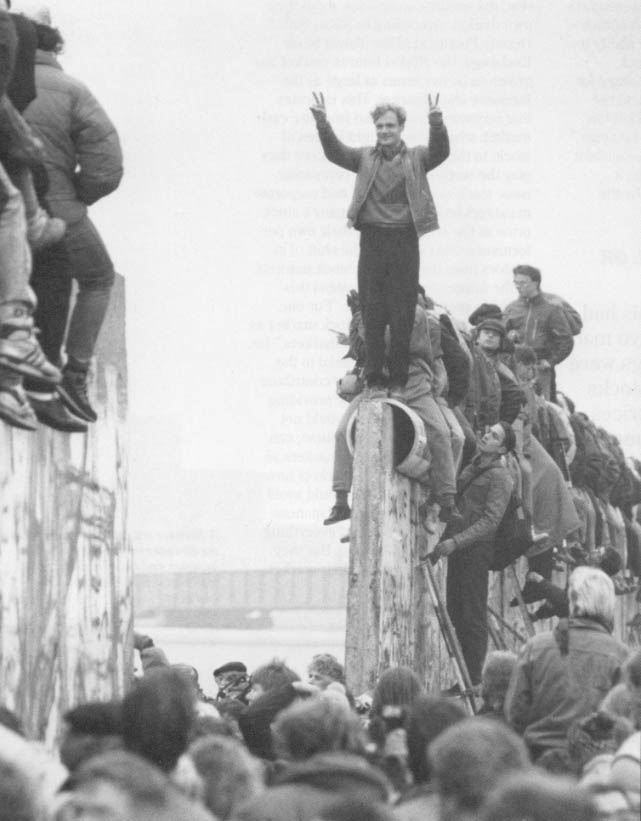

Notwithstanding these practical benefits, speculation still has a seedy image, and foreign speculation looks even worse. “Futures are like gunboats,” Michael Hoffmann, senior vice president of DTB Deutsche Terminborse, Germany’s new futures exchange, “Fast, you’re in and out in seconds.” German authorities were tinder the gun. They saw greedy traders in London, responsive to short term price moves rather than long term economic fundamentals, shaping the financial destiny of Germany without any guidance from the German government. “The fact that the biggest contract in London was the German government bond contract was a sore spot,” Hoffman says. In order to try and recapture control over its own financial system, Germany changed the its laws to permit establishment of the first futures exchange since the 1930’s. So far, the Frankfurt-based DTB has managed to recapture only 30% of the market for financial futures, and sortie sources doubt that the German share of futures trading in German debt will ever grow to much more than a third.

GUNSMOKE

In the wake of World War II, governments cooperated to build an international system of financial law and monetary order.

The Bretton Woods system maintained relative financial stability in the Western world for nearly thirty years, but at a high cost. “The system worked tolerably well only because the USA was willing to stand there and finance the balance of payments deficits of other countries,” says Milton Friedman, the Nobel laureate whose theories led the Nixon administration to abandon Bretton Woods. Since the breakdown of the old system, only one law has been consistently enforceable: capital flows to the highest return.

During the past twenty years, the Western countries have been taking apart, piece by piece, all of the structures and rules that used to work when the world was stable. Regulators compete to deregulate, because if their regulations are onerous they will have nothing to regulate at all. Financial markets are like ships flying flags of convenience-they choose the laws they will obey

Aware of the practical benefits that futures bring to investors, knowing that a derivative market on their financial system Could easily develop with or Without their consent, fearful that their domestic capital markets Could be swamped by foreigners trading in a remote financial capitol, governments are now doing whatever is necessary to set up derivative markets in their own jurisdictions. During: the past five years, some 13 new futures exchanges have been established around the world. Jenkins says, “Governments felt they had an interest in rejuvenating their capital markets. As part of that process a sort of virility symbol is, you have to have your futures and options markets as well, because they are the up and coining things.”

Like the Colt .45 on the Western frontier, derivatives command respect. But like the Colt, they are most useful in a lawless land.

©1992 Gregory J. Millman

Gregory Millman, a financial journalist based in New Jersey, is examining the effects of the world’s new financial markets.