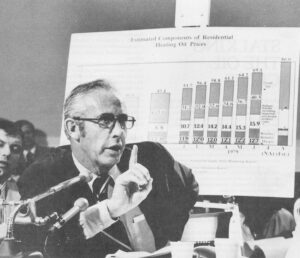

WASHINGTON, D.C.–During the puzzling oil crisis of 1979, while oil companies and their critics argued over the reasons for gas lines and soaring prices, one little known public official, Dr. Joachim W. Koenig, had more inside information about what was going on than anyone else outside the industry.

As emergency oil allocations coordinator for the International Energy Agency (IEA), Koenig became the closest thing the world has ever had to an international oil ombudsman, and his outlook on the crisis, outlined in classified IEA documents, differs substantially from the version given the public by U.S. government and industry spokesmen.

Koenig’s findings raise new questions about the actions of major oil companies during the crisis. The IEA documents portray the world’s oil consuming countries as the losers in a struggle for information on why the world price of oil was doubling and what, if anything, the countries could have been doing to stop it.

Contrived Shortage

Other internal IEA, Department of Energy (DOE) and oil company documents raise additional points that support Koenig’s conclusions, indicating that the actual world oil shortage was small or nonexistent, that the U.S. government’s assertion of a two-million-barrel-a-day shortage was based on contrived numbers, that the profit motive figured heavily in some company supply decisions, and that DOE officials operated in the dark on some fundamental questions. The documents also show that the companies cited U.S. antitrust laws as their reason for not responding to appeals by the IEA that they refrain from bidding up world oil prices in a way that invited the Organization of Petroleum Exporting Countries (OPEC) to follow suit.

Koenig is a tall, blunt-spoken German who used to be an executive of Exxon’s European branch. Although Koenig and his agency are unfamiliar to most Americans-his name does not even appear in the New York Times Index for 1979-the IEA was a central forum for the clash of interests between countries and companies during the 1979 confusion. The U.S. and most of the world’s other oil-importing democracies set up the agency shortly after the 1973-74 Arab oil embargo, mainly to deal with oil emergencies and to gather oil information.

In 1979, it became Koenig’s job to assess how serious the new shortage was, to investigate complaints from countries where the squeeze was particularly severe, to meet with the various industry committees that advise the IEA, and to exhort the companies to restrain prices and distribute oil fairly.

Every month, bulky classified reports from the world’s 33 largest oil companies arrived on Koenig’s desk at IEA headquarters in Paris. They contained confidential data on each company’s movements of oil around the world. Koenig also had the clout, which he used frequently, to call in senior oil executives for private talks on how they were handling the shortage. In all, Koenig got what amounted to the best keyhole view an outside official has ever had into the murky world of international oil trade.

Controversial Report

After the crisis, Koenig wrote a report that infuriated some company officials on the IEA’s advisory committees. Although the report has never been released, its findings are outlined in other IEA documents. According to those documents, Koenig found that:

Major oil companies exacerbated a relatively minor shortage by building up “excessive” stockpiles of oil and gasoline during the spring and early summer of 1979, instead of releasing the supplies to the marketplace.

The companies did not give enough facts to the IEA and the consuming nations’ governments, creating what Koenig called a “crisis of information” instead of a “crisis of volume. “

As a result, the consumer governments, especially the United States government, grew excessively worried about heating oil supplies for the winter of 1979-80 and took actions that helped worsen the gasoline shortage and drove up world oil prices.

These points have been argued before, with some variations, by critics in Congress and the press. But the significance of Koenig’s conclusions lies in the unique vantage point he had for evaluating the crisis. His findings contradict those of DOE and the Justice Department, both of which issued reports portraying the U. S. shortage as the inevitable result of a world oil shortfall of two million barrels a day caused by the shutdown in Iranian oil production between December, 1978, and March, 1979.

Oil executives criticized Koenig’s report as unfair and based on what several called “20-20 hindsight.” They said that even though Iran resumed oil exports in March, 1979, turmoil in the new revolutionary regime caused companies to hold onto some stocks as a prudent hedge against further disruptions.

However, an examination of the shortage, based on documents and interviews with company officials and outside experts raises points that reinforce Koenig’s conclusions.

For instance:

Despite sworn statements to Congress bv Exxon and Gulf that they distributed oil without regard for expected profit margins in different countries, executives of both companies wrote memoranda which make it clear that the opposite was true. The memoranda show that the companies, despite prodding from Koenig, declined to supply enough oil to relieve a particularly large shortage in Sweden until the government substantially relaxed price controls. Robert Wilson, an Exxon International official, said in an interview that companies were being asked to sell expensive spot market oil at a loss in Sweden. “The only way the companies could put pressure on the government was to refuse,” he said.

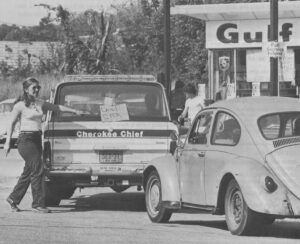

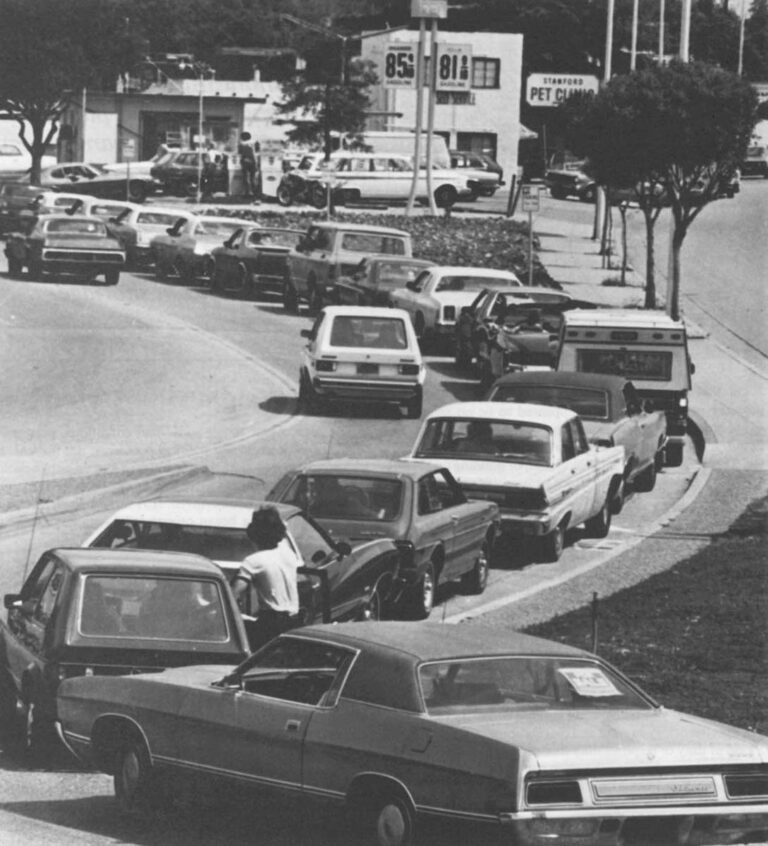

While the Carter administration was telling Congress and the public in the spring of 1979 that a 2 million-barrel-a-day world shortage existed, it had access to IEA reports saying there appeared to be no significant shortage. The IEA Secretariat’s confidential analysis on March 28, 1979, said: “Oil is flowing from the wells and being imported by consuming countries but, through justifiable prudence perhaps reinforced by a speculative element, it appears to be sticking in the distribution system.” DOE proprietary figures show many major companies in the U.S. held more gasoline in storage during the May and June gas lines than they had had the previous year. A Texaco spokesman said: “There were, in retrospect, sufficient oil supplies in the first half of 1979 to have avoided the shortages that occurred.”

The administration stuck with its assertion of a 2 million-barrel-a-day shortage to justify price decontrol for crude oil even though it knew a key assumption behind that figure was wrong. Peter Deutsch, a Senate Judiciary Committee analyst, discovered an internal DOE paper saying that the 2 million figure depended on the assumption that “Iran will produce only enough oil for domestic consumption, about 800,000 B/D, through the first quarter of 1980.” But by April, 1979, Iran was producing 4 million barrels a day. Deutsch wrote a detailed study of the shortage concluding: “Since the shortage due to Iran was not significant and at worst was only a temporary aberration in the international petroleum system…the rationale for the Carter energy plan is flawed.”

Throughout the shortage, senior DOE officials remained ignorant of basic facts necessary for evaluating what was happening in the world oil market. On July, 16, 1979, after the U.S. gas lines had largely disappeared, Harry Bergold, assistant secretary for international affairs, admitted to a Congressional hearing that DOE still did not know what criteria the companies used to allocate oil among their subsidiaries around the world. Bergold said: “We have tried to find out…I cannot testify to what they are doing for sure.” Senator J. Bennett Johnston, chairman of a Senate energy subcommittee, wrote to two high-level DOE officials to ask if companies were diverting Caribbean-refined heating oil from the U.S. to higher-priced European markets. He got contradictory answers. Lincoln Moses, administrator of DOE’s statistics branch, replied: “We have no evidence to indicate that middle distillates [which include heating oil]…have been diverted from U.S. to European markets.” But Peter Borre, DOE’s deputy assistant secretary for trade and resources, replied: “There is some evidence that during second quarter 1979 the large price differential…led to the movement of petroleum products to Europe which under more normal circumstances would have remained in North America. “

A Code of Conduct

Koenig’s conclusions on the crisis are outlined in transcripts and memoes of IEA meetings. For instance, at a September 13, 1979, meeting of the IEA’s Industry Advisory Board, company delegates objected strongly to Koenig’s idea that the crisis suggested the need for an oil industry “code of conduct. “

“Dr. Koenig responded that the IEA has two roles beyond emergency sharing,” one memo says. “One is assuring a flow of information. The other is coordination of government actions and policies. In the current crisis some governments took steps that were not coordinated and were harmful…He suggested that an effort should be made to determine how measures can be developed that will prevent excesses in the oil market. “

The memo also says: “Dr. Koenig was asked what the Secretariat means by a ‘crisis of information.’ He responded that the 1979 crisis, which represented a shortfall of less than 5 per cent at its height, was felt as severely in the Western world as the 1973-74 crisis, which represented a cut of 8 percent. As a result, actions were taken which contributed to price escalation.

“Governments underestimated the ability of the system to rebuild heating oil stocks, and about April 1 they began putting pressure on companies. That pressure contributed to gasoline shortages and spot price increases…He concluded that a reason for all this was a lack of information concerning what was available within the existing system.”

On March 21, just a week before the IEA Secretariat reported privately that there appeared to be no significant world shortage, Robert Dolph, president of Exxon International, made a grim prediction to the Senate energy committee. There was “no hope,” Dolph said, of building up heating oil stocks to normal levels before winter. “We estimate that only about half of the needed replacement could be accomplished,” he said. (In fact, heating oil stocks reached normal levels by early fall.)

Dolph assured the senators that Exxon was distributing oil around the world without considering differences in profit levels in various countries. “We are allocating our shortfall across the board using the same percentage for all the areas of the world in which we have interests,” Dolph testified. “We are not trying to say that we might make a little more money if we allocated a little more to Germany and a little less to France. It is across the board and equal to everybody.”

Senator Howard Metzenbaum asked skeptically: “You are suggesting that you put your oil in those countries where you can’t get the price you want and that for some reason you have a kind of duty or responsibility that causes you to put it there when you are not getting the price you want for it?”

Dolph: “Yes, I would say that’s a fair statement.”

Gulf submitted a similar statement for the hearing record: “Gulf’s allocation system in response to the Iranian crisis…was based on our contractual obligations and was not influenced by market conditions in the consuming areas. “

The companies’ statements were, at best, disingenuous. Sweden’s experience during the crisis illustrates plainly that money does influence where oil goes, a point that would hardly be news if companies didn’t devote such effort to denying it. Sweden was heavily dependent on spot market imports, and its price controls resulted in profit margins lower than other European countries. When spot market prices soared in early 1979, Sweden’s supplies dwindled quickly. In May, Sweden formally asked the IEA to implement its emergency oil sharing plan.

The plan, never tested under real conditions, presents a tangle of diplomatic and political problems, not the least of which is that it could force companies to make a public choice between the interests of OPEC and those of consuming countries. So, a compromise evolved: IEA turned down Sweden’s request, but Koenig began private talks with companies to urge them to send more oil to Sweden.

A Company Memo

On May 23, Koenig spent an hour and a half in a conference call with Gulf officials in London and Pittsburgh. One of the Gulf executives, G.G. Nimick, described the company’s thinking in a memo:

“Although Gulf normally buys 8-10 per cent of its product requirement for Sweden in the spot market during the summer, it may not do so in 1979 if cargo prices remain at their current levels…Sweden is among the worst performers for Gulf in Europe at present. Gulf declined to answer the question, ‘Under what conditions would Gulf be prepared to take on new business in Sweden?’, as this could only be decided at the Executive level. According to Dr. Koenig, Sweden claims that, with their latest boost of $25 per ton, their prices are in the middle of the range of European prices. Gulf maintains that this is insufficient to cover marginal business, and that Sweden (and the UK) have permitted the smallest increase in realizations since fourth quarter, 1978, compared to other countries in which Gulf operates.”

On June 12, Koenig talked to Mark Vendrick, vice president of Exxon International. Exxon’s Swedish subsidiary, Svenska Esso, had told Swedish officials to expect reduced supplies that month. According to a memo written by Venrick, Koenig said the IEA’s executive director, Ulf

Lantzke, “was most concerned that this is showing a lack of cooperation on Exxon’s part.”

“I told Dr. Koenig that…we would be following our allocation principles, aimed at sharing the burden equitably.” Venrick wrote. But Venrick added a qualifier that his boss, Dolph, hadn’t mentioned in his Senate testimony: Countries don’t necessarily get the oil that Exxon International allocates. “

“I concluded the story,” Venrick wrote, “by saying that in his discussions with the Swedish authorities, Mr. Sjogren, Svenska Esso’s president, did say that he might not avail himself of all the supplies which Exxon offers him if he felt these supplies did not fit into Svenska Esso’s local marketing strategy and profitability criteria. I indicated to Dr. Koenig

that this was in keeping with the prerogatives Exxon affiliate managers have to run their local businesses.”

Robert Wilson, manager of planning for the supply and transportation department of Exxon International, elaborated on that point in an interview. Speaking of Exxon’s subsidiary managers around the world, he said: “He’s responsible for his bottom line. I don’t get blamed if he loses money-he does. So he has to have that flexibility. We’ve got a whole series of profit centers. We can’t sit here and make decisions for those profit centers. All we can do is make supplies available on a fair basis.”

The Marginal Barrel

Carl Tham, Sweden’s energy minister during the crisis, said sufficient oil began to flow into Sweden after the government raised prices several times. “Shell told us if we were not going to have higher prices, they would sell the oil they bought on the spot market to other countries in Europe,” Tham said. “We lost some cargoes.” When Sweden complained to the IEA, he said “They told us, ‘If you just increase your prices, you can buy oil. It’s always possible to buy oil.”’

One expert on the shortage, Edward Krapels, a Washington energy consultant and author of two oil books, said most of the struggles for oil in 1979 involved “the marginal barrel”-the last few percentage points of supply that can make the difference between shortage and comfort. Often, Krapels said, the big companies have bought this oil at top dollar on the spot market. “The companies say if you want this marginal barrel, you’ve got to give us a higher price,” Krapels said. “The governments say ‘if we set the price by that marginal barrel, you’ll wind up with a windfall on all the rest.’ The governments that control prices are going to run into this problem inevitably.” Italy also suffered a worse shortage than most of Europe, and its problems persisted into 1980. According to another IEA memo, when IEA officials asked Mobil to step up oil shipments, the same problem was cited: “Italian prices have been well below average European prices.”

The U.S.-based companies serve on the IEA’s advisory committees under special exemptions from American antitrust laws. The theory is to prevent the companies from exchanging proprietary data and from acting in concert in their marketing strategy. But during the 1979 crisis, concerns over antitrust issues wound up hampering the IEA’s efforts to protect world oil consumers-exactly the opposite of what antitrust is supposed to accomplish.

A spokesman for Texaco, for instance, acknowledged that the company had cited antitrust concerns in declining to give IEA its corporate supply-demand forecasts during the first four months of 1979, even though other companies were supplying their own supply-demand figures. The IEA adds up individual companies’ figures to try to get an overall picture of the world oil market. So until Texaco changed its mind in May, the IEA had to operate without supply-demand forecasts from the third-largest U.S. oil company.

On May 18, with gas lines springing up in the U.S., world prices rising drastically and consuming-nation governments seeking industry’s advice on what to do, the industry representatives simply stood up as a group and walked out of the room when the subject of price came up, according to another memo by Venrick. The memo says the oilmen walked out on the advice of their antitrust lawyers, who said if they acted in concert to influence prices, they might be vulnerable to antitrust suits. The question of who would actually file such a suit went unexplained, but the curious fact is that, under the letter of present law, the companies are technically correct.

Industry in Wonderland

A report by the Federal Trade Commission, which monitors IEA meetings for antitrust purposes, inadvertently captures some of the Alice in Wonderland quality of all this. At an Industry Advisory Board meeting, the report says, “a Secretariat representative began discussing the problems that had been created when companies rushed to replenish inventories, driving up prices immediately before an OPEC meeting. He added that if oil companies continued this practice it would send the wrong signals to OPEC. The chairman of the IAB [Venrick of Exxon] interrupted the Secretariat’s observations by explaining the sensitivity of the topic and that it was not the type of discussion in which the IAB should participate.” The report quotes Venrick as saying “one of the great concerns I think we have…is not to let any discussion, no matter how admirable the results might be for the welfare of the consuming nations…move down the avenue where someone might construe it” as an antitrust violation.

David Schooler, counsel to the House subcommittee on energy conservation and power, believes Congress has to rethink antitrust policy as it affects IEA and come up with something that gives IEA a better chance to exert some influence in times of price panic. “Replacing the wildly competitive behavior which drove up world oil prices on the spot market and contributed to the doubling of OPEC oil prices with a coordinated approach to reducing stocks and reducing bidding could conceivably save consumers billions of dollars,” Schooler wrote in a staff paper. “In fact, competitive behavior in such circumstances may be the consumer’s worst enemy.”

©1981 Brian Donovan

Brian Donovan is investigating U.S. petroleum policies.