WASHINGTON, DC–John O’Leary has spent most of his adult life grappling with one tentacle or another of America’s energy problem. Generally he’s been armed with an impressive title. His resume lists a long string of high-level government energy posts. At various times he has been a top regulator of natural gas, coal, nuclear power and oil. He runs a successful energy consulting firm. He speaks with first-name familiarity of his contacts in world finance and various governments. As a well-off Washington insider of 55, O’Leary would seem to have reached a career peak from which he could look back upon a distinguished past and ahead to a comfortable future.

Actually, as O’Leary tells it, he takes little pleasure in looking either forward or back. As deputy energy secretary under President Carter, O’Leary played a central role in the government’s efforts to deal with the oil crisis of 1979, an event whose effects, he says, are still devastating the American economy. When O’Leary looks back, he judges himself harshly for what he describes as the government’s failure to handle the crisis properly. He puts it bluntly: At a crucial time, he and his fellow policy makers simply blew it, with costly results.

When O’Leary looks ahead, he says it’s with doubts that anyone in America can be confident of a comfortable future. He says the country is likely to experience an economic disaster in the next oil crisis, because of the Reagan administration’s failure to learn from the Carter administration’s mistakes. The Carter people failed to realize the long-term damage that higher oil prices could do to the economy and therefore failed to give enough thought to steps the government could have tried to calm the market and keep prices down. The free-market Reagan strategy, which O’Leary calls “dangerous,” puts the federal government on the sidelines for the next oil crisis. In policy papers, the administration has said that the price of oil products will rise sharply in the early part of a crisis, that prices will prove the best allocator of scarce supplies, and that prices will drop back to their old level once supplies improve. In past crises, however, OPEC has used such price surges as justification for increasing the long-term price.

Some significant share of the 1979 oil price increases probably could have been averted, O’Leary said, if he and other top officials had better understood the real problem: protecting the economy. During 1979, the Carter administration used the crisis as an opportunity to convince the public to conserve–an approach that, while well-meaning, struck some critics as conflicting with any goal of ending the crisis quickly with minimum damage. O’Leary gives himself and the Carter administration a withering review:

“All I can say is that we did badly. We weren’t focused. There wasn’t a clear enunciation and recognition of the nature of the damage that a price run-up can do. We were frightened by the short term political reaction and influenced overly by that. Probably we were naive in the way we handled the problems. And of course, the proof of the pudding is in the eating. I don’t see how it could have been much worse in terms of results…I don’t think in retrospect that I appreciated the really nasty consequences of the price increases we experienced during that period.”

The Struggle for Oil and Information

In two recent interviews, O’Leary discussed some previously unreported aspects of the struggle for oil and information in 1979 and talked about some of the lessons he says should have been learned. O’Leary said that:

Oil companies operating in Alaska misled him about the potential for producing more Alaskan oil to help relieve the market panic that followed the temporary loss of Iranian supplies in early 1979. As a result, the government remained unaware that clearing up pipeline bottlenecks would produce an additional 400,000 barrels a day of Alaskan oil.

The government’s efforts to persuade American companies to refrain from bidding up spot market oil prices were generally ineffectual, with some companies even refusing to discuss the matter.

The French unsuccessfully urged the U.S. and major European allies to adopt a strategy to calm spot market prices through an agreement banning all oil imports at more than the OPEC price. O’Leary said he thinks the plan could have worked.

The Western nations should handle the next crisis by expanding the powers of the International Energy Agency (IEA), an organization made up of the U.S. and 20 other oil importing countries, and should use the IEA to temporarily take over one of industry’s most significant powers to influence price during a crisis–the ability to draw down its large stockpiles to offset supply disruptions. Industry stock building during 1979 contributed significantly to price increases, many analysts say.

The Reagan administration has said it will take a pure free-market approach to any future oil crisis. There will be no mandatory allocation of petroleum products, no price controls, no jawboning of oil companies, no government intervention of any kind. No plans exist for what to do with the oil in the Strategic Petroleum Reserve, the government’s emergency stockpile. United States’ support for allied cooperation in crisis management through the International Energy Agency has been lukewarm at best. Administration officials say that price is the best way to allocate any scarce commodity, that an uncontrolled marketplace will serve consumers most efficiently, and that prices will drop back to their old level once adequate supplies return. Others say the Reagan approach is summed up in the title of a recent two-volume General Accounting Office study: “The United States Remains Unprepared For Oil Import Disruptions.”

O’Leary agrees. Although the current administration may prefer to weather the next crisis with no government intervention, O’Leary says, a more likely prospect in a real emergency is a panicky intervention by Congress, resulting in hastily drafted allocation and price laws that work even more badly than the ones that were in effect in 1979 and have now been scrapped. In the leadership vacuum and public outcry, he says, “They’ll pass legislation and stuff it down the president’s throat. It will be highly inefficient and, I think, altogether unfortunate.”

Influencing Industry (1)

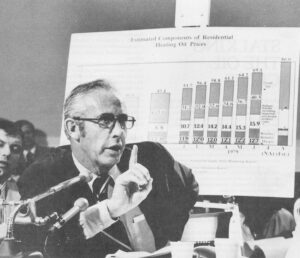

After the decade’s first oil shock in 1973-74, a senior Exxon official, George Piercy, testified to Congress about one of the main reasons for the price increases suffered by the West. The main problem, Piercy said, was the West’s lack of what oilmen call “spare capacity”–the ability to step up domestic oil production to help offset a cut in imports.

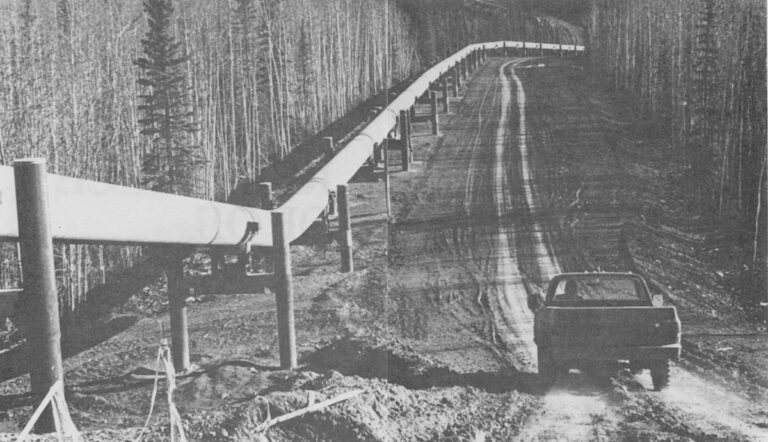

By 1979, one major change had emerged on the domestic oil scene. The U.S. had brought its largest single oil field, Alaska’s North Slope, into production. The oil travels to market through the Alaska Pipeline, built to provide a maximum flow of two million barrels a day. But in early 1979, actual Alaskan production was only 1.2 million barrels a day because two of the pipeline’s pumping stations remained unfinished. The companies had no commercial incentive to add more pumps–Alaskan oil already had created an aggravating, price-dampening surplus on the West Coast.

O’Leary called together the companies operating in Alaska to find out if the pipeline flow could be increased. “I had a series of meetings with them in the spring that I have since regarded as the lest responsive sessions that I’ve ever had with industry. I said, ‘Here’s the 1.2 million, is that the maximum?’ And the answer came back, ‘Mumbo, jumbo, mumble, jumble, yeah, that’s the maximum…I was left with the strong conviction, having probed this in more than one meeting, that there was no more that could come out.”

O’Leary said he gave the matter no more thought until well after the crisis was over. Then he came across statistics showing that Alaskan production had risen by gradual increments until it reached 1.6 million barrels a day in early 1980. The companies, it turned out, had installed the missing pumps and further increased pipeline flow with a friction-reducing additive. The spare capacity had existed after all. But the additional oil arrived too late; by then, OPEC’s prices had doubled.

O’Leary said he was furious. “I said to myself, ‘Boy am I mad at those bastards,’ because they stood there and stonewalled, and I had reported back to the president, ‘I think that I put on all the pressure that you can, and nothing much is going to happen.’ ” Recently, he said, he ran into two executives who’d been at the meetings. “I said, ‘You sonofabitch, you guys stood there and told me what you couldn’t do, and then you went out and did it.’ ” The oilmen, O’Leary said, told him the real problem had been something never discussed at the meetings: One of the companies hadn’t wanted to put up its share of the money for the pumps and had to be pressured by the others. O’Leary said he could not recall which company was reluctant. “It was somebody who didn’t benefit much from it, didn’t want to do it, had its cash in some other line,” he said.

The potential availability of an additional 400,000 barrels a day of American oil, during a crisis whose magnitude DOE estimated at 500,000 to 800,000 barrels a day, was hardly an insignificant piece of news. But the government remained ignorant, the companies settled their money dispute in private, and the expansion moved ahead without government oversight at a pace that, in the end, failed to have any effect on soaring prices.

“I felt that I had been lied to,” O’Leary said, “just plain lied to. And apparently, I had.”

A Lost Opportunity

During both the major oil crises of the 1970s, O’Leary said, the real damage to Western economies started with dramatic price surges on the world spot market, where oil cargoes not under contract are bought and sold for whatever the traffic will bear. Then and now, the spot market remains outside the control of both individual governments and the International Energy Agency, a body of 21 Western oil-importing nations set up after the 1973-74 crisis to deal with oil supply disruptions and encourage international cooperation in energy. The spot market involves only a small fraction of world oil supplies, but its importance goes beyond its size. In both crises, OPEC pointed to high spot market prices as its justification for raising official prices far above the levels it had planned previously.

Since the first oil shock, other Western governments have looked upon the French as suspiciously cozy with OPEC. France was the only major Western government to refuse membership in IEA, apparently out of fear that joining would antagonize OPEC nations, some of which buy French nuclear hardware. But surprisingly, it was France that proposed what O’Leary said was probably the most effective plan for calming down spot market prices and OPEC’s price ideas.

The plan was a simple one, put forward in private talks between American officials and French Industry Minister Andre Giraud. “The French, who exercise a great deal more control over their whole supply system than we do, came to each of the principal members of the IEA,” O’Leary said. “They said, ‘Why don’t we extend the French system internationally?’ That would be to say [to major oil companies and speculative trading companies], ‘You can go out and buy all the $35 crude on the spot market that you want. But when you land it here, it’s worth only $22 on a first-sale basis, maximum.’ ” Each government would enforce that price ceiling, freezing oil import prices at the official OPEC price and depriving those who bought costlier spot-priced oil of most of the noncommunist world’s major markets.

The idea never got the necessary support–frantic spot market bidding, first by Japan, then by Germany and others, undermined any hope of allied cooperation and helped keep prices rising all year. But O’Leary said the French plan might well have stopped much of the market panic and is worth trying next time. Four countries, he said, hold the key to success. “The United States, the French, the Germans and the Japanese would have had to agree,” he said. “And that would have done it.” The plan, of course, represents the opposite of a free market approach; O’Leary said the chances of this administration trying it are just about nil.

Influencing Industry (2)

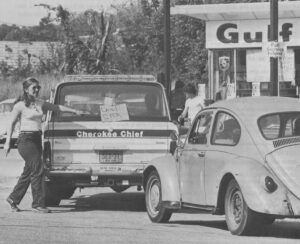

With no international plan for controlling the spot market, the United States’ only alternative was a voluntary approach: calling in companies and exhorting them not to bid up the spot price. O’Leary handled many of those meetings. The major companies, with their diverse sources of supply around the world, expressed the most cooperative attitude, probably because they did not need much spot market oil anyway, O’Leary said.

The problems, he said, came from medium-sized, crude-short refiners willing to pay exorbitant prices just to stay in business and from trading companies that stood to make hundreds of millions by playing the tight market shrewdly. “We got the full gamut of responses,” O’Leary said, “from ‘Yeah, yeah, you’ve got to do that,’ up to open hostility, refusal to talk.”

(In O’Leary’s reminiscences, there was one consistent gap in his memory, possibly reflecting both the large number of meetings he had with industry and his continuing need to make a living in the energy business. Each time he described an encounter with an uncooperative company, he could no longer recall which one it was.)

In any event, O’Leary said, “I don’t think that my representations to the companies made an awful lot of difference. I think they knew that so long as they didn’t publicly flout the Department of Energy there was very little we could do about their actions. Their actions were largely private. They weren’t well publicized. We couldn’t catch up with individual actions by any reporting system that we had in place until a good long time had passed.”

Early in the crisis, he said, some officials talked of using the domestic regulatory system to punish defiant companies. DOE’s special counsel, Paul Bloom, the official in charge of price control enforcement, used his clout over the companies to extract data for a special data system called Crude Watch, which O’Leary said opened up a clearer picture of what was happening in the oil market. “By June or July,” O’Leary said, “we could see some of the companies that were very heavily in the spot market, who were really just forced to push prices way, way up. But by that time we weren’t retaliating. The damage had been largely done in the run-up in the official [OPEC] selling price.”

Conservation: Second Thoughts

One of the Carter administration’s greatest failings, O’Leary said, was its unquestioning attitude that energy conservation is, without qualification, a good thing–even when achieved through significant price increases. O’Leary said he has been raising eyebrows on the lecture circuit recently by arguing that, at least in its economic impact, conservation through higher prices “is evil.”

“What we always ought to bear in mind,” he said, “is that only a trivial portion of the cost of an energy increase, an oil price run-up are born during the immediate shortage period. The real costs are three, five, even 10 years out. What you really have to concern yourself with are the long term effects.”

Between crises, he said, the real price of oil, factoring out inflation, goes down; the OPEC cartel, despite its formidable power to jack up prices during a supply disruption, has never been able to keep the real price up in years when the market is soft.

“But in between the time of the price run-up and the time that a real price re-equilibrium is established, you’ve got some pretty horrendous costs to the society. I think we’re seeing them now in the sustained inflation and the reduced capacity of the economy to produce nice regular increases in productivity.”

Just a few years ago, many top officials felt that if the U.S. could only cut oil imports by two or three million barrels a day, the country would be well on the way to solving many of its economic and national security problems. Now, imports are down to about five million barrels a day from the 1977 peak of 8.7 million. However, O’Leary said, “I can’t think of much good that it’s done.”

“We’re worse off strategically,” he said, since most of the easy conservation steps have been taken and the country remains massively dependent on Arab oil. “Real family income is declining, and I suspect it will go off very, very sharply during the 1980s, maybe as much as 25 percent,” due to the greater share of family income consumed directly and indirectly by energy costs. “If I were in the position today that I occupied in ’79, I would be much more focused on pushing the organization in directions that would minimize price increases…They would be in the realm of price controls, stock management and allocation–anything that would minimize the upward pressure on price.”

What Next?

Reagan administration officials say they are confident that while prices may shoot up drastically in the early part of an oil crisis they will drop back to their prior level once supplies are restored. That is consistent with freshman economics, which teaches that higher prices produce more supplies, which restores equilibrium. That simple formula, however, doesn’t account for what can happen when a hostile foreign cartel controls a big chunk of the supply.

“I think it’s really very dangerous,” O’Leary said. “I really can’t believe that any administration would permit the development of a situation such as we faced in early 1979 without intervening in the market. And this administration, in sort of a doctrinaire sense, and I suspect without focusing on it very hard, has taken down the machinery for intervention.”

What should be done? As O’Leary sees it, a unified stand by the consuming countries, through a strengthened IEA, is the only real hope. “We have to get serious about this international mechanism,” he said. “You can’t wait till a crisis begins to decide what your objective is, because by that time you can’t possibly put in place the machinery to do the policing.” The first principle, he said, should be that the IEA countries will not chase after the last few percentage points of supply on the top-dollar spot market. “Second, the objective of the International Energy Agency has to be to move through the emergency with no increases in price. Third, we have to do that by creating a climate in which our nationals cannot profit from the spot price. That will require controls on the landed price and reporting sufficiently good that we know of any breeches of the price rules. Fourth, we are prepared to allocate [among IEA countries] on the basis of last year’s usage.” Countries should not be allowed to divert this oil into government strategic reserves. “If a country hasn’t built adequate strategic stocks, too bad–they’ve chosen to take a debit.

“Finally, the governments would have to assume total responsibility for stock management”–in effect, a temporary takeover of industry’s powers by the IEA. “You couldn’t have any stocks on shore or offshore that weren’t subject to the same rigorous discipline. If you do all that, you can ride out the sort of thing we’ve had twice now and probably will have once or twice more before we see the end of it. You can’t ride out the long ones, but you can sure ride out the three- or four-month ones.”

Merely relying on allocation by price to sort out a crisis is, as O’Leary sees it, a recipe for economic disaster. The Carter administration did that, O’Leary said, “in sort of a half-assed way and we failed. If you go to it deliberately, you’re going to fail a lot worse.”

©1982 Brian Donovan

Brian Donovan is investigating U.S. petroleum policies.