Balancing potential human health hazards versus herbicide spraying, bartering long-term forest improvement for needed short-term profits, gambling on untested energy systems–all are complex decisions that reflect the philosophies and styles of the forest industry executives who make them.

In 1979, St. Regis Paper Company banned herbicide spraying on its Maine timberlands after a spray drift accident that killed vegetables in 200 gardens and allegedly caused human health problems. As a result of the incident, 28 Washington County residents filed a $100 million lawsuit that still isn’t completely settled. St. Regis vice president Taggart Edwards was the senior executive who stopped the spraying, and he held to the prohibition over the protests of company foresters, even when St. Regis was taken over by Champion International Corp. Edwards admits to a strong personal bias against herbicide spraying. He believed exposure to the chemicals potentially threatened the health of employees working with them. His high-level position enabled him to stave off the economic pressures for spraying until the summer of 1986, when Champion reintroduced herbicides on a small portion of its 700,000 acres in Maine. But by that time, Edwards had established the most stringent spray control regulations in the forest industry.

Last year, Great Northern Paper Company president Robert F. Bartlett decided to eliminate the company’s tree nursery, planting and herbicide spraying programs–essential parts of a forest quality improvement program. Bartlett was under the gun from parent Great Northern Nekoosa to slash operational costs and regain profitability in the struggling Maine operation. Without substantial earnings improvement, Great Northern was told it could not obtain from Nekoosa’s board of directors the financial commitment to modernize the Millinocket paper mill, its Maine flagship. In the collision between a decision leading to a short-term earnings gain or meeting the long-term needs of Great Northern’s declining spruce-fir timberlands Bartlett was forced to choose the side of bottom-line immediacy.

Charles Schmidt, former president and chief executive officer of the S.D. Warren Division of Scott Paper, was in decision-making turmoil during most of his seven years with the company. He was faced with an obsolete mill at Westbrook, Maine, and was constantly having to do what managers don’t like to do–”betting the farm” on one survival project after another. Then oil prices went sky-high in 1979. Warren was burning 882,000 barrels in its five fuel oil boilers, but its primary market rival, Consolidated Papers Inc., used less expensive Montana coal, enabling it to sell a ton for paper for $100 under Warren’s price. The only way for the mill to remain competitive was to burn inexpensive wood. But Schmidt didn’t have any way to know if existing wood-burning systems would be economical. He gambled on new technology but had to engage in “internecine warfare” with the competing Scott tissue division for $85 million from the board of directors to build the boilers. The system worked beyond expectations, adding significantly to the mill’s profit margin.

All three decisions are the kinds that can affect a timber-dependent state’s landscape and economic well-being–in this case that of Maine, New England’s woodbasket. With Champion’s renewed herbicide spraying and Great Northern’s elimination of intensive forest management investment, the effect is on the raw resource. In the S. D. Warren situation, the impact is on the community, where the paper mill is the dominant employer. Some 2,000 jobs that pour millions of dollars into the area were saved by Schmidt’s calling the right shot.

The outcomes, however, could have been different if the decision-makers had possessed different personalities and prejudices. If Edwards hadn’t disliked herbicide spraying so much, it would have resumed much earlier–and in some observers’ minds given Champion a healthier, faster-growing wood source close to its Bucksport paper mill. If Bartlett had been a forester instead of an accountant, he might have figured out a way to meet his financial goals without sacrificing future timberland quality. If Schmidt had been less of a risk-taker, S. D. Warren in Westbrook easily could have succumbed to competition.

Health vs. Profit

Looking across the American pulp and paper/forest products industry, it is clear that personality strengths and weaknesses greatly influence decision-making. Sometimes, individual preferences are vigorous enough to overcome the drive to maximize profits, usually the primary factor in decision-making.

Edwards’ decision on herbicide spraying is a perfect example. His reservations about the impact on human health of herbicides outweighed the profit motive that dictated a quick resumption of spraying to “release” valuable softwood growth from choking by junk hardwoods. Paine-Webber paper company analyst Larry Ross says Robert Pamplin, who ran Georgia-Pacific for about 20 years, was among several in the industry’s previous generation of leaders who also overlooked profit demands at times. “Pamplin had his views on investing capital and spending that were critical to success,” Ross recalls. Despite Pamplin’s training as an accountant, Ross said, “I don’t think he paid too much attention to return on investment.”

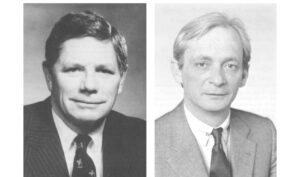

Personality strengths and weaknesses greatly influence decision making in the American pulp and paper/forest products industry. Two key decision-makers are Charles W. Schmidt (L.), senior vice president, Raytheon Corp; and Taggart Edwards (R.), executive vice president, Champion International Corp.

Today, Champion’s Andrew Sigler, Boise Cascade’s John Fery, and Louisiana-Pacific’s Harry Merlo stand out as chief executive officers whose philosophies and gutsy nature account for much of their decision-making. And the Weyerhaeuser family is on any analyst’s list of industry CEOs willing to give up maximizing profit for a higher goal, in the Weyerhaeusers’ case, husbanding trees. Robert Leone, a public policy lecturer at Harvard University’s Kennedy School and former Presidential economic advisor, says the large-scale Weyerhaeuser commitment to intensive forest management has never made short-term financial sense. But the investments have panned out, defying the numbers game, he said.

But analyst Ross maintains there’s a lot of flexibility for management to act differently because “there’s no way really to predict” the future. Accountants “may sound authoritative by saying ‘we should invest in this because the rate of return will be 18 percent,’ ” but such projections are “built on sand,” according to Ross, due to the volatility of the business. “It’s common that a new CEO will have his own view, like the President of the U.S. has his own political agenda. Forest companies are always getting in and out of business, acquiring mills, building them, and then selling.”

Charles Schmidt, now a senior vice president at Raytheon who allowed a Costigan, Maine, stud mill to operate too long after it was a money Corporation, said in an interview that he intensely pushed his view on how to save the anachronistic Westbrook mill. That involved discarding the then-typical hierarchical decision-making approach of “the man at the top” and replacing it with a team concept. “Everyone communicated outside his discipline, and that way we didn’t crush people’s creative ideas” on how to save the paper plant, he said. Schmidt built a geodesic dome-type model to explain his theory of how successful communication worked. “We were all points on the dome,” he said, adding jokingly that it made some people think he was “a turkey.” But “the gallows concentrated the mind,” he said, and he still uses the geodesic dome concept at Raytheon.

Champion’s Edwards believes his employees cringed at some of his traits and tactics. Visiting troubled company stud mills, which make structural materials for use in the housing industry, he resorted to “harassment” to try to motivate workers to improve production. Edwards’ method is to tell them “you’re not doing well, we’re going to shut your ass down. We’ve got to get rid of some people.” Edwards admits he’s “made a lot of bad decisions.” One was allowing the Cost-loser. He also kept company crews cutting wood on company lands when he should have hired private contractors at less cost. “I was emotionally tied to those company crews,” he said. “I was certainly tied to that Costigan stud mill when any logical person would have closed it. But I was involved in building it, and you get tied emotionally to these things.”

Great Northern’s Bartlett refused numerous requests to discuss his decision-making style.

The differences in CEOs’ personalities and perceptions account for why companies facing the same market conditions go numerous ways-with different product lines, geographic locations, internal structure, managerial ideology, and timberland assets. As an example, Stone Container’s strategy reflects CEO Roger Stone’s preference for the corrugated box and bag market. The Chicago-based company recently bought Champion International’s packaging operation, which Champion wanted to get rid of because CEO Sigler and the board of directors thought it was a terrible business to be in.

Because forest products–from toilet tissue to 2×4’s–touch everyone’s daily life, the decisions that drive the $135 billion industry (in sales) would seem to be as vital a concern as those affecting the auto, telephone, and high tech industries. Bestsellers about Ford, General Motors, Chrysler, AT&T, and International Business Machines have flooded the book market, but there’s a vacuum of information about what goes on in the pulp and paper and forest products companies.

Ed Durkin of the United Brotherhood of Carpenters and Joiners of America says Wall Street analysts who spend all their time analyzing decisions and strategy have “such a shallow view” of the industry that they don’t present it “as interesting and worth attention” . Analysts, like institutional money managers, are “very short-term…what’s it paying right now,” he said.

On the public side, there has been little demand to know more because forest products don’t have a strong market identification. Other than tissues, consumers don’t shop for paper, plywood, or studs on the basis of brand name, as they would when buying a car or a computer. But then, there are only three major automakers, while there are 10 times that many leading forest industry companies.

Add to all of those factors the industry’s state of flux. Restructuring to fend off takeover raiders is in vogue. Companies are cutting costs, shaking up and slimming down management, scrapping unprofitable product lines, and spinning off timberlands. A company’s decision-makers and internal structure can change overnight. In Scott Paper’s effort to be more efficient, it cut its management levels from 11 to five, eliminating a lot of middle-management staff and pushing decisions down closer to the ground level. At Georgia-Pacific and Boise Cascade, decisions have been made recently to favor building up the paper side, since there is more profit in paper now than wood products. International Paper, known for decisions favoring papermaking and shortchanging research and development is now moving into new product innovation to beat competition from Japan and Scandinavia.

One inevitably comes to the question of decision-makers’ accountability in a business world where quick return demands are constantly in conflict with the needs of the slow-growing forest, whose rotation cycle is 40 years or more. Who pays when there’s a bad call? Doesn’t the forest bear the brunt of most wrong moves? Historic information on that point is nonexistent, according to University of Oregon researcher Stuart Rich. Forbes magazine reporter Kathleen Wiegner, who specializes in covering the forest industry, points out that it takes so long to build a mill or realize benefits from planting trees, that knowing if a decision was good or bad is hard to determine. If an answer unfolds, responsible senior management may have retired.

For instance, Potlatch bought 93,000 acres of timberlands in 1981 for $135 million, or $1,450 an acre. That price was double the offer of a competitor but Potlatch was willing to gamble that the trees’ future value would justify the high cost.

However, shortly after the purchase, timberland values crashed. Potlatch was saddled with enormous carrying costs. One analyst said the decision “looks real stupid today,” but given time it may prove to have been a very smart move. In another similar case, Louisiana-Pacific’s Harry Merlo recently decided to ignore industry sentiment against acquiring timberlands and last year snapped up 750,000 acres (at very low prices), nearly doubling his company’s holdings. The move makes sense from the perspective of wanting a guaranteed source of wood supply. But it will take years to evaluate Merlo on that decision.

Decision-Making Errors

There’s a difference of opinion within the industry and outside on whether decision-making errors are fatal to the company career of the one calling the shot. Lester DeCoster, vice president of the American Forest Institute, says if they’re wrong, “you pay with your head.” But William Bell of Wagner Woodlands in Lyme, New Hampshire, a timberland investment and forest management company, and a former pension fund manager says that if top managers “are right 51 percent of the time, they are considered successful.”

Sometimes, employees are so sure a supervisor’s decision is wrong that they quit rather than obey it. Champion’s Edwards said that when he significantly increased clear-cutting on Maine timberlands in the 1970s, some company foresters quit, and he had to fire others who resisted his orders. They were so upset, they couldn’t even lay out the tote roads, Edwards said. They believed the accelerated harvest would irreversibly harm the forest and its non-timber values, such as wildlife and the water quality of rivers and streams.

Maine is the most forested state in the nation. About 40 percent of its 17 million acres of timberlands are owned by six of the leading industry players–Great Northern Paper, IP, Champion, Scott, Boise Cascade, Georgia-Pacific, and Diamond-Occidental. (Louisiana-Pacific and James River have mills in Maine but no woodlands.)

One of the frequently heard complaints from Mainers over forest issues is that once the companies moved their headquarters outside the state, that ended local decision-making; the industry lost touch with what was good for the state, so the folklore goes. Some observers remember former days when a woodlands manager didn’t have to call out of state to get approval for his actions, and there wasn’t a frequent turnover in the timber bosses. But the last of the old generation has retired “and that type of personality may not exist anymore,” reminisces Dr. Max McCormack, a research professor with the University of Maine’s Cooperative Forestry Research Unit. “Or maybe the corporation doesn’t let that person exist anymore.”

What It Takes To Do The Job

Changes in decision-making power coupled with the rotation of woodlands managers says something negative to people like McCormack, who remembers that once he could tell who was in charge of the different timberlands just by looking at how the logging roads were built. He points out that Great Northern Paper has had three woodlands managers in five years, and two of them were trained in accounting and engineering, not forest biology. That kind of mobility, McCormack says, counters “what it takes to do the job”–a familiarity with the land over a long period of time.

In fact, many more key decisions are made locally than believed, especially operational ones. At corporate headquarters in New York or Stamford, the chief executive officer (CEO) and his staff don’t sit around deciding whether to clear-cut a certain township in Maine. That’s left up to the woodlands manager in Maine. The typical forest industry CEO isn’t worried about trees but about policy and finance issues, such as the rate of return, stock values, quarterly financial showings, shareholder dividends, and raiders. Even if multinational Scott or IP were headquartered in Portland, Maine, the overall decisions would be the same, according to company spokesman.

Personality and profits aside, history has an important effect on how decisions are made. It influences a company’s direction in showing that certain past decisions led to success. Take Great Northern’s vast hydro dam system. Cheap water power has been a key ingredient in the company’s competitive success. Anytime Great Northern needed additional energy in the past, it built dams on the Penobscot River and recently tried to add to its hydro system. This time, however, the company was challenged by a coalition of special interest opponents who argued that there were competitive, less environmentally damaging alternatives. Environmentalists maintained that Great Northern had tunnel vision based on its faith in a proven technology with which they were intimate. The company held to its position that hydro was the best alternative, but eventually the project was abandoned.

The increasingly decentralized decision-making structure in the industry reflects the complexity of the far-flung businesses. The result is that today’s forest corporations are run without any one senior executive having full knowledge of its operations. University researchers have done studies showing a discrepancy between middle managers’ understanding of their goals and those of senior management. The rub here is that the timberlands in the hands of the industry contain valuable public resources, notably wildlife and watersheds. Those resources can be adversely affected (sometimes for decades) by profit enhancement decisions such as overcutting forest stands to boost earnings.

There’s no way for forest companies to consistently make the 10 to 12 percent return demanded by shareholders without being short-term, according to economists. “You have to ‘do something wrong today’ to make the kind of profits shareholders and Wall Street demand,” said Julius Impellizeri, president of Elmendorf Corp., the New York-based company that developed oriented strand board, a plywood substitute. “But you can’t sustain it. It’s like a pyramid scheme.”

Some industry observers believe that the early 1980s recession wiped out most of the gamblers, and conservatives came out smelling like a rose. One said the average manager is “a super conservative type. The legacy of the recession is that making bold decisions is out.” Impellizeri said, “You can’t criticize a board for going in to something when there’s too great a risk. But you can criticize when they lose money.”

“Financial people typically give foresters a hard time because they want cash out of the forest and foresters feel timber growing will go up in value,” says analyst Ross. “If timber rises six percent a year and the finance person is paying eight percent, it makes sense to liquidate. You’re dealing with the future, and no one knows. People go on the basis of their personal experience, and so you can’t generalize.”

The profit-making decisions, however, do include more than just visions of hard cash. Yale University forest economist Clark Binkley says that one of the major changes over the last decade has been to get some of the economic costs considered when profit maximizing decisions are made. But Boise’s Robert Withrow said it’s hard to make MBA’s understand the other factors that must be rolled in. For example, there’s more of a financial advantage to clear-cutting and “it may be financially correct,” he said. “But environmentalists and community people may not agree, and the company may not be able to clear-cut for a public relations reason.”

The short-term decision-making of today’s management is not surprising, given their backgrounds and the unprecedented pressures of Wall Street for faster and bigger returns. Almost all executives are from finance and business training and moved up the company ladder through sales, marketing, or production–not forestry. In Champion’s case–and indicative of the industry–only one of the 18 executives was trained in forestry. And the new legion of takeover artists are certainly not trained to appreciate the long-term needs of the forest. Dave Pease, editor of Forest Industries magazine makes the point that these takeover artists have “accelerated harvest on their minds” to increase profits, at the expense of the forest.

©1987 Phyllis Austin

Phyllis Austin, a reporter on leave from the Maine Times, concludes her investigation of how the pulp and paper industry has fostered the crisis in the Maine woods.